Defined Benefit and Pension Plans

Experience Simplicity in a Complex WorldTM

Traditional defined benefit pension plans offer many advantages to both business owners and employees as both a retirement funding and talent retention tool. Due to annual funding calculations, proper investment management of pension plans is more important than ever. Experienced guidance from a team of advisors serving in an investment fiduciary capacity can help you pursue specific plan goals and objectives.

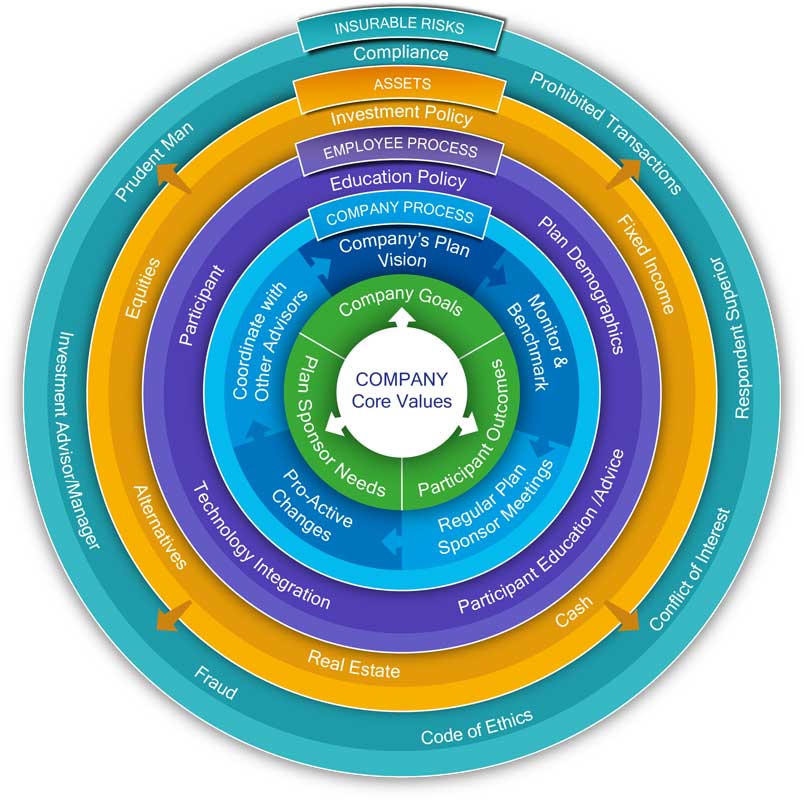

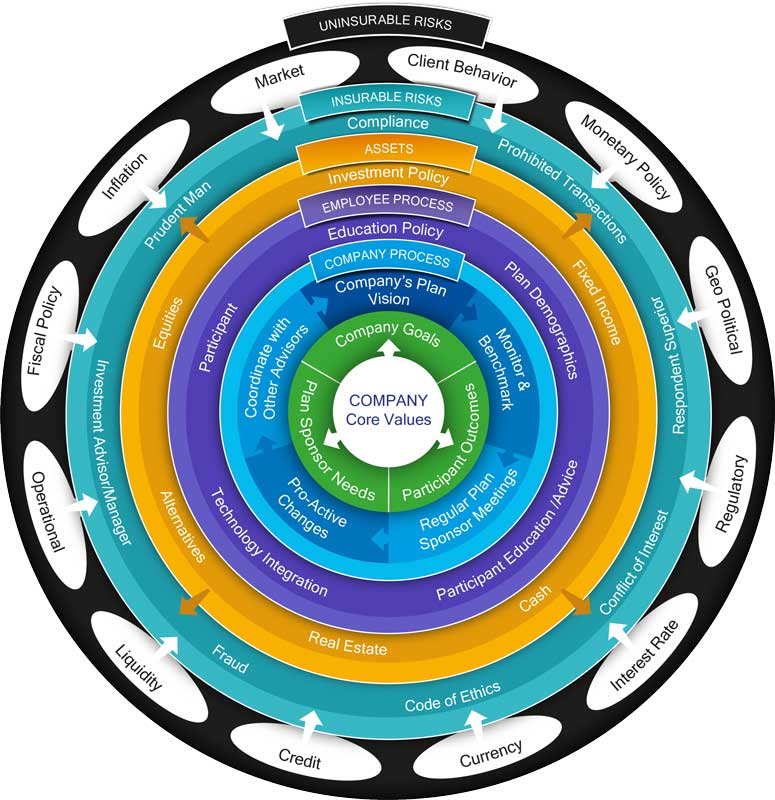

The investment fiduciary advisors at 401(k) ProsperityTM serve as an extension of your internal team, assisting you in establishing and/or maintaining a consistent, ongoing, documented process of prudent oversight and due diligence. We help identify potential risks, so you can choose to accept the risk, delegate the risk, or institute procedures to manage risk. The investment fiduciary advisors at 401(k) ProsperityTM can provide:

- Dedicated expertise and resources required to craft a well-constructed and coordinated strategy aligned with your needs, goals, and desired outcomes,

- Unbiased, timely, and actionable advice to effectively anticipate and manage risks and determine the right opportunities for your organization.

401(k) ProsperityTM works closely with companies of all sizes to help them:

- Protect and grow their investments

- Educate participants on this important benefit

- Assist retiring and terminating employees in understanding their distribution options

- Coordinate the benefits of both the 401(k) plan and the pension plan

Real People…Real Answers

401(k) ProsperityTM is committed to providing you and your employees with objective, actionable guidance across the full range of your defined benefit plan needs.

Our holistic approach can help you pursue the outcomes you seek for your valued employees:

What do you want to accomplish?

- For you

- Your company,

- Key contributors, and

- Employees

- While large traditional defined benefit plans exist, they have been fading from the retirement plan landscape. However, Cash Balance Pension Plans have grown in popularity in recent years due to the benefits they offer for small to midsize companies.

- A Cash Balance Pension Plan is a qualified plan enabling employers to credit participant accounts with a set percentage of their yearly compensation plus interest charges. Such plans have become popular with owners of closely-held businesses as an effective way to drive large cash funding dollars into key employee accounts.

- Often, if the company census is conducive to plan design, only an acceptable base contribution amount has to be contributed to non-key employees. This creates another method to reward key employees with significant retirement dollars while generating an additional deductible expense for those in higher tax brackets.

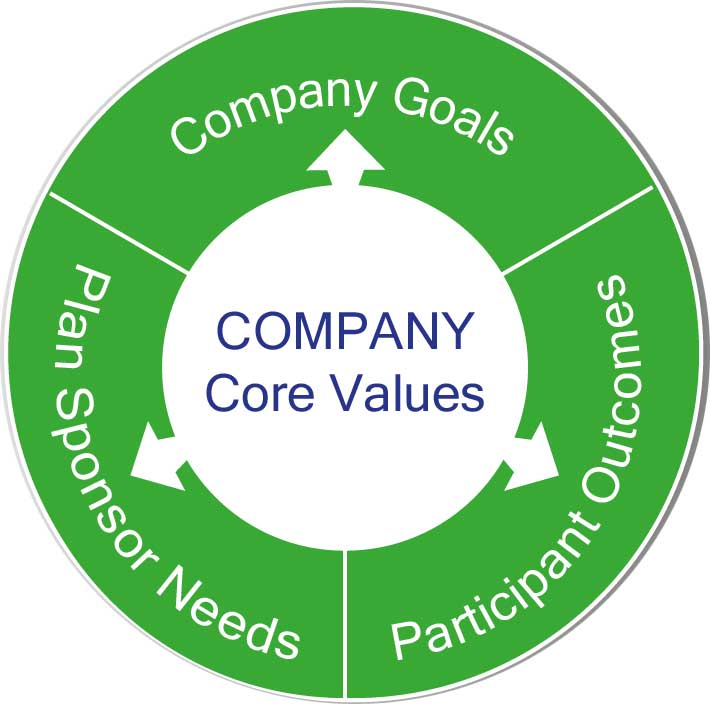

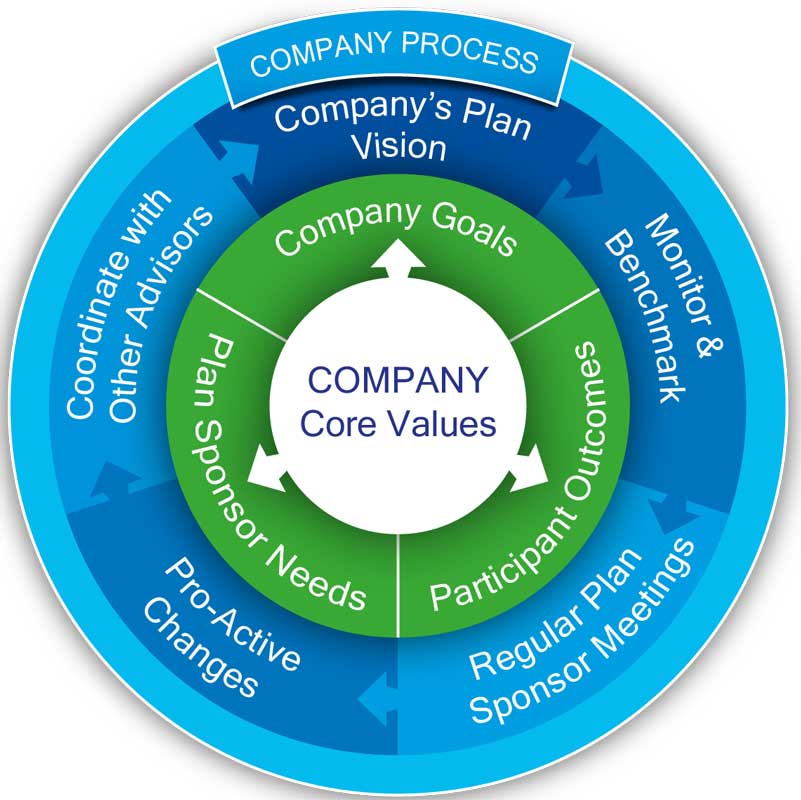

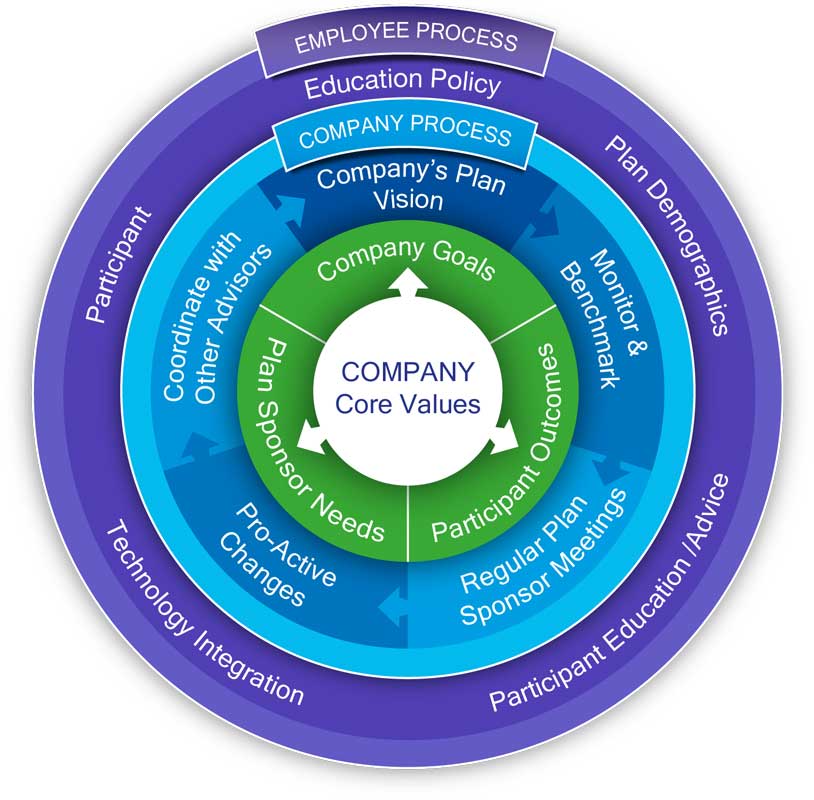

Benefit from a disciplined and defined process

The 401(k) ProsperityTM pension plan process continually centers on your vision for your company and employees. You can expect our experienced team to:

- Develop customized strategies aligned with your needs and goals

- Work with your other advisors to coordinate advice

- Proactively monitor and benchmark your progress

- Meet with you, your Investment Committee, and/or Board of Directors regularly

- Provide customized reports based on your needs and preferences

401(k) ProsperityTM makes it easy for your employees to obtain the information, education, and unbiased advice they seek from our team of highly experienced, investment fiduciary advisors, either face-to-face, via phone, or through the latest virtual technologies. Your employees benefit from:

- Education on this valuable benefit; how it works; and the important role it plays as part of their overall compensation

- Personal assistance in understanding distribution options for terminating and/or retiring employees from our team of experienced, investment fiduciary advisors

Fiduciary investment advice and guidance

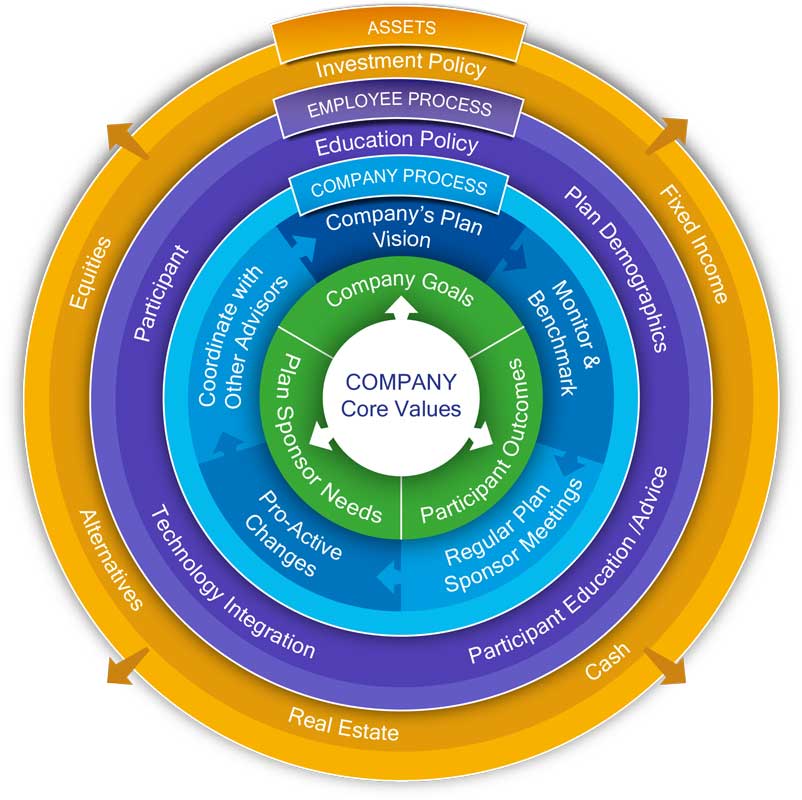

401(k) ProsperityTM works with you to develop a comprehensive Investment Policy Statement (IPS) aligned with your goals that reflects your unique mandate, and our team’s collective insights, knowledge and expertise. As an independent firm, our experienced investment fiduciary advisors:

- Approach the markets with complete objectivity

- Provide balanced and unbiased evaluations and recommendations

- Offer capabilities and access beyond traditional investment strategies

Protecting what matters

- As independent, investment fiduciary advisors, our team helps to:

- Protect your organization’s fiduciaries

- Avoid conflicts of interest

- Create a system for managing risk while maintaining:

- Prudent Man investment standards

- High ethical standards

- Compliance with industry and corporate governance standards

Our experienced team includes advisors with the following industry designations and/or certifications:

- Accredited Investment Fiduciary® (AIF®)

- Professional Plan ConsultantTM (PPCTM)

- Certified Financial PlannerTM (CFP®)

- AICPA Personal Financial Specialist (PFS)

- Certified Public Accountant (CPA)

- Chartered Financial Analyst® (CFA®)

Putting It All Together

401(k) ProsperityTM considers both internal and external dependencies and risk factors that may impact your ability to pursue your company’s goals and objectives, including:

- Fiscal and monetary policy

- Financial markets

- Credit markets

- Liquidity

- Geopolitical climate and events

- Inflation and interest rate risk

- Regulatory environment

- Currency

- Operating environment

- Client behavior

For more than 22 years, 401(k) ProsperityTM has forged relationships with industry leaders, service innovators, and top institutional investment providers to help plan sponsors and their participants pursue the outcomes they seek.

401(k) Prosperity® Prosperity Pension Services

Fiduciary Support Services

- Investment Policy Statement (IPS) development

- Plan design to help improve plan outcomes

- Participant education and advisory strategies

- Vendor management relationship support and coordination

Investment Analysis and Monitoring

- Performance measurement/reporting

- Quantitative and qualitative analysis

- Manager research/recommendations

- Quarterly market commentary

Plan Analysis, Research and Benchmarking

- Fee analysis, disclosure and benchmarking

- Asset allocation and diversification analysis

- Gap analysis

Project Engagements

- Merger and acquisition plan due diligence assistance

- Vendor search coordination and assistance

- Plan sponsor support service analysis

PFS FACILITATED SERVICES

- CPA/Attorney/Banker introductions

- Third Party Administration introductions

This information was developed as a general guide to educate plan sponsors, but is not intended as authoritative guidance or tax or legal advice. Each plan has unique requirements, and you should consult your attorney or tax advisor for guidance on your specific situation. In no way does the advisor assure that, by using the information provided, the plan sponsor will be in compliance with ERISA regulations.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, member FINRA/SIPC.