Foundations & Endowments

Experience Simplicity in a Complex WorldTM

Foundations and endowments are established to make a difference for the individuals, organizations, and communities they support on an ongoing basis. Therefore, it’s not only essential that your foundation or endowment delivers on its responsibility to gather donations, but puts proper financial oversight in place to support the organization’s legacy and help perpetuate it for decades to come.

Successful foundations and endowments recognize that obtaining the right help for managing the many internal and external forces that influence financial outcomes can be critical for families, institutions, and not-for-profit organizations seeking to expand the long-term impact of their philanthropic strategies.

The experienced, independent advisors at 401(k) ProsperityTM provide:

- Dedicated expertise and resources required to develop a well-constructed and coordinated investment strateg

- Unbiased, timely, and actionable advice to effectively anticipate and manage risks, and determine the right opportunities for your private/public foundation or endowment.

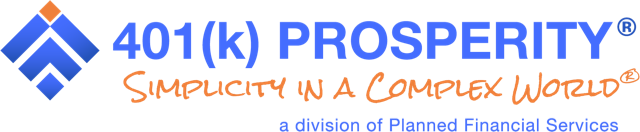

The 401(k) ProsperityTM team’s holistic approach can help your foundation or endowment pursue its unique vision and mission with clarity and confidence:

What do you want to accomplish?

- Organizational goals

- Benefactor goals

- Endowment goals

A disciplined and defined process

Once we have a clear understanding of your vision and mission, our trusted advisors bring their collective insight, knowledge, and experience to collaborating with you to develop an Investment Policy Statement (IPS) aligned with your goals that reflects your organization’s unique mission, vision, and mandate.

- We work with your other advisors to coordinate advice

- Proactively monitor and benchmark your progress

- Meet with you, your Investment Committee, and/or Board of Directors regularly

- Provide customized reports based on your needs and preferences

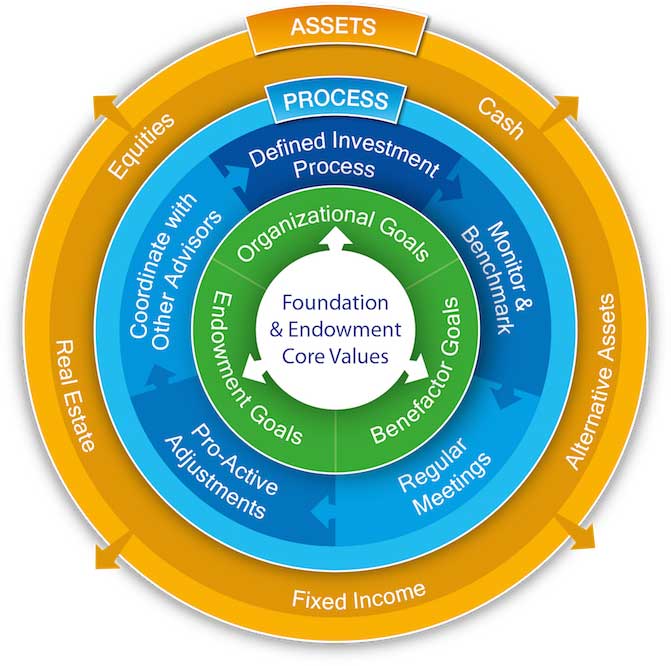

Prudent risk management

Our team is experienced in helping organizations of all sizes develop prudent risk management strategies that seek to balance the need for preservation, growth, and cash flow. As we continuously monitor your portfolio, we will recommend any adjustments required to further help manage risk and help strengthen the impact of your giving.

We manage your portfolio with a focus on:

- Expected returns

- Cash inflows and outflows

- Risk parameters

- Permitted investment classes

- Asset allocation restrictions

Protecting what matters

As independent investment advisors, our team helps to protect your organization’s fiduciaries and avoid conflicts of interest by creating a system for managing risk while maintaining:

- Prudent Man investment standards

- High ethical standards

- Compliance with industry and corporate governance standards

Our experienced team includes advisors with the following industry designations and/or certifications:

- Accredited Investment Fiduciary® (AIF®)

- Professional Plan ConsultantTM (PPCTM)

- Certified Financial PlannerTM (CFP®)

- AICPA Personal Financial Specialist (PFS)

- Certified Public Accountant (CPA)

- Chartered Financial Analyst® (CFA®)

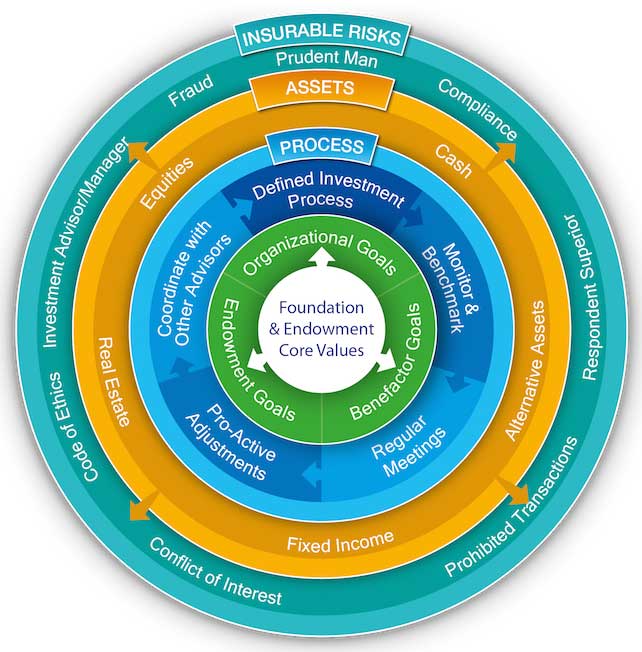

Putting It All Together

401(k) ProsperityTM considers both internal and external dependencies and risk factors that may impact your investment portfolio or your ability to pursue the goals, vision, or mission of your foundation or endowment, including:

- Fiscal and monetary policy

- Financial markets

- Credit markets

- Geopolitical climate and events

- Inflation and interest rate risk

- Regulatory environment

- Currency

- Operating environment

For more than 22 years, Planned Financial Services has forged relationships with industry leaders, service innovators, and top institutional investment providers to help foundations, endowments, and not-for-profit organizations pursue their unique mission and vision. As an independent firm, our experienced team of wealth advisors:

- Approach the markets with complete objectivity

- Provide balanced and unbiased evaluations and recommendations

- Offer capabilities and access beyond traditional strategies for managing risk

- Work collaboratively to help capture the opportunities that are right for you

Services for Foundations & Endowments

- Investment Policy Statement (IPS) development

- Investment Management

- Tax Strategies

- Estate & Legacy Planning

- Complete Family Office (CFO)SM

- Family Continuity - multigenerational planning

- Investment Committee training and guidance

- STAR® – celebrity financial management

PFS Facilitated Services

- CPA/Attorney/Banker introductions

- Trust Administration introductions

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, member FINRA/SIPC.